Latest articles

Let’s say you’re 65, getting ready to retire, and you’ve saved up $1.5 million. That’s no small feat — congratulations. But now comes the big question: “How much can I actually spend each year without running out of money?” It’s something almost every retiree worries about. After decades of saving, the idea of seeing your…

Winning a massive lottery jackpot like the Powerball or Mega Millions is a once-in-a-lifetime event—but it also comes with major financial consequences. Whether you’re holding a winning ticket for $2.04 billion like the historic Powerball prize in November 2022, or you’re the lucky recipient of a recent $1.58 billion Mega Millions jackpot, it’s critical to…

If you’re a high-income professional looking to save more for retirement and reduce your taxable income, you’ve likely already hit your 401(k) limit. So what’s next? Enter the Cash Balance Pension Plan—a powerful retirement tool that can allow you to contribute well into six figures annually, all while slashing your tax bill. In this post,…

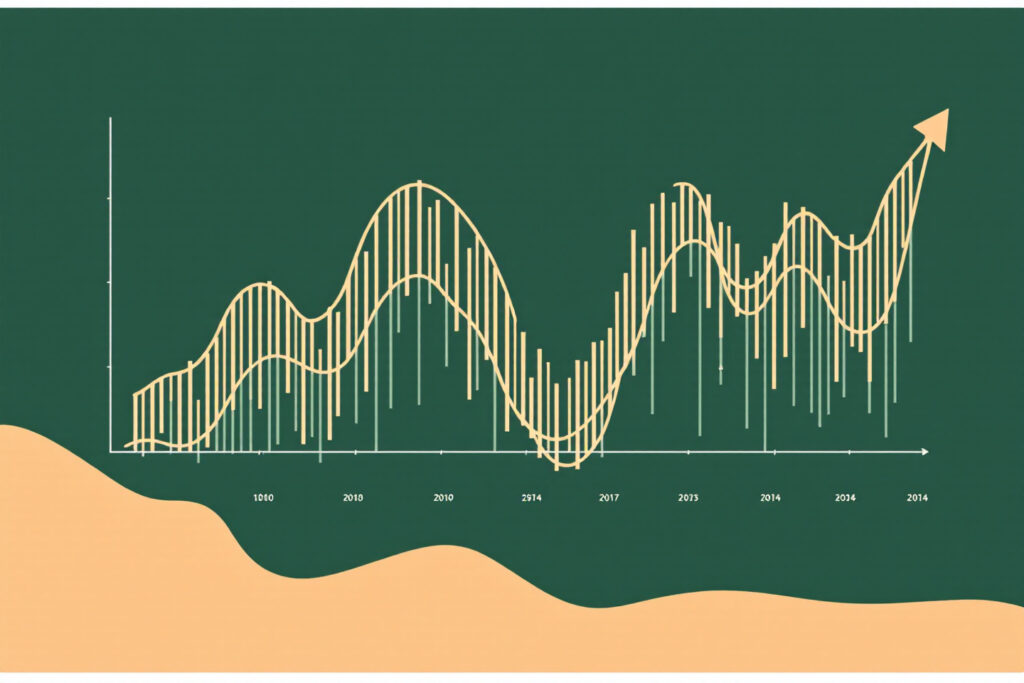

As 2026 approaches, the U.S. financial landscape is entering a period of significant uncertainty. From a historic credit rating downgrade to looming tax law changes, individuals and families—especially those with global assets or U.S. residency—face important decisions. If you’re holding U.S. assets, planning to transfer wealth, or preparing for retirement, now is the time to…

Your credit score is one of the most critical financial indicators, affecting your ability to secure loans, mortgages, credit cards, and even rental agreements. A higher credit score opens doors to better interest rates and financial opportunities. This step-by-step guide outlines 10 proven strategies to help you boost your credit score and build a strong…